Spotify Picks A Fight With Apple in the EU

Elf

Spotify takes aim at Apple in the EU, accusing the Cupertino tech company of anti-competitive practices in the App Store

Spotify filed a legal complaint with the European Commission against Apple, its main competitor in the music streaming space, by claiming that the Cupertino tech giant follows anti-competitive practices. Specifically, Spotify argued that Apple is paid too much in the App Store from developer apps, does not provide enough information on customers to vendors and has restricted third-party access to Apple’s native technologies such as the Apple Watch, Siri and HomePod. Spotify' claims that Apple’s restrictions to its own native technology and information in the App Store make it harder for Spotify to compete.

Daniel Ek, Spotify founder, took direct aim at Apple, complaining on his company’s blog, stating that Apple’s position as owner of iOS platform and the App Store gives Apple “an unfair advantage at every turn” and asked for help from the EU. Ek compared Apple’s 30 percent fee of App Store purchases via its in-app purchase system (IAP) to a “tax” and complained that it forced his company to lower their pricing to be competitive, which was not affordable for them. His grievance list included complaints about Apple’s payment system and being unable to access Apple’s native technologies such as Siri, HomePod and Apple Watch. Ek said it was unfair that Apple restricts how much access developers have to customer information. Ek’s demand list included payment to Spotify directly through the App Store, bypassing Apple’s standard fee and more access to customer information to market directly to them.

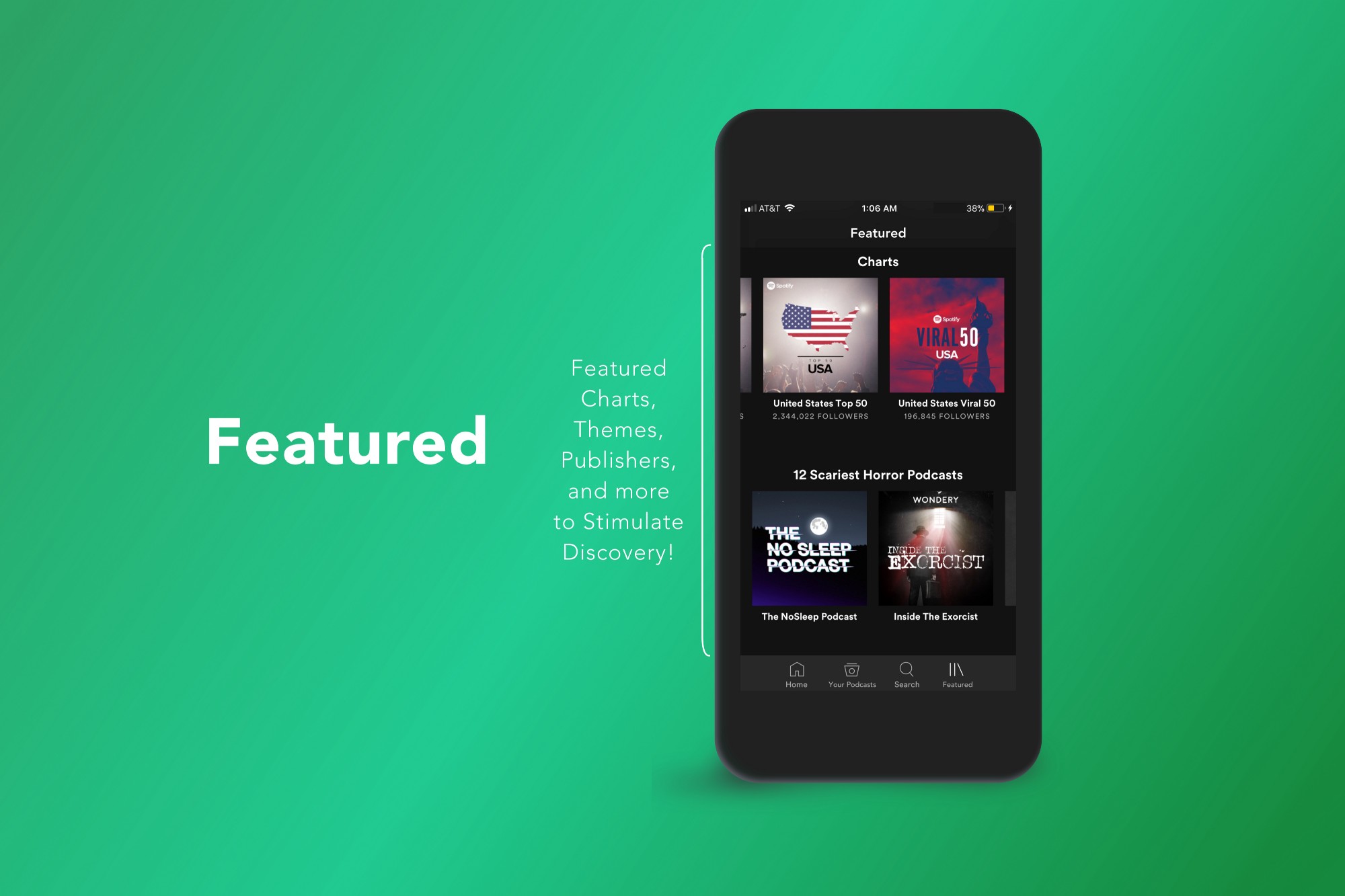

Spotify currently maintains a lead over Apple Music in terms of subscribers, coming in at 87 million compared to Apple’s 56 million (both figures were previously reported publicly by both companies). To be competitive, Spotify has expanded into the podcast space, buying up two podcasting companies, Gimlet Media and Anchor for record fees earlier this year. Spotify also recently partnered up with Hulu to offer a new subscription model.

Spotify Struggles to be Profitable

Despite launching in 2008 a year after the launch of the iPhone, Spotify has not been profitable until this year. The company joined a list of tech companies that were unprofitable at the time of their IPOS. In February 2018, when Spotify went public on the New York Stock Exchange with the SPOT ticker, the company’s shares launched at a price tag of $165.90 apiece, giving the company a $23.5 billion valuation. At the time of its IPO filing, Spotify had a net loss of $1.5 billion for 2017, even though it generated $5 billion in revenue and had acquired 160 million active users.

In a financial statement and announcement to shareholders on February 6, 2019, Spotify shared that the company was profitable for the first time in the last quarter of 2018. The music-streaming giant made an operating profit of €94 million (approximately $107 million). Despite the good news, the profits may not last. Spotify forecasts a loss of €50- €100 million (about $57 to $113 million) next quarter and €200-€360 million (about $227-$409 million) over the full year.

In Spotify’s complaint, General Counsel Horacio Gutierrez said that the company needed marketing promotions to convert free customers to premium (paying subscribers) and that Apple’s system prevented Spotify from gaining enough information about customers.

Apple’s Response

Today, a day after Spotify’s announcement of its antitrust complaint, Apple responded in detail. Apple pointed out that Spotify "wraps its financial motivations in misleading rhetoric" and wants to "keep all the benefits of the App Store ecosystem, including the substantial revenue that they draw from the App Store’s customers, without making any contributions to that marketplace."

“After using the App Store for years to dramatically grow their business, Spotify seeks to keep all the benefits of the App Store ecosystem — including the substantial revenue that they draw from the App Store’s customers — without making any contributions to that marketplace. At the same time, they distribute the music you love while making ever-smaller contributions to the artists, musicians and songwriters who create it — even going so far as to take these creators to court.”

Apple categorically rejected Spotify’s claim that Apple had blocked the company from updating its apps. In a detailed press release, Apple shared how it had supported Spotify’s new apps, including addition of Spotify to CarPlay and its Apple Watch app, which is the “No. 1 app in the Watch Music category.” Apple said the company is free apps for the App Store and compete directly with Apple.

“We’ve approved and distributed nearly 200 app updates on Spotify’s behalf, resulting in over 300 million downloaded copies of the Spotify app. ”

Apple refuted Spotify’s claim that Apple charged all developers too much, saying that 84 percent of the apps in the App Store pay nothing to Apple when you download or use the app.

“Spotify wants all the benefits of a free app without being free.”

Addressing Spotify’s complaints that Uber and Deliveroo do not pay fees and Spotify is charged “unfairly,” Apple then went on to explain how the App Store model works:

Apps that are free to you aren’t charged by Apple.

Apps that earn revenue exclusively through advertising — like some of your favorite free games — aren’t charged by Apple.

App business transactions where users sign up or purchase digital goods outside the app aren’t charged by Apple.

Apps that sell physical goods — including ride-hailing and food delivery services, to name a few — aren’t charged by Apple.

The only contribution that Apple requires is for digital goods and services that are purchased inside the app using our secure in-app purchase system. As Spotify points out, that revenue share is 30 percent for the first year of an annual subscription — but they left out that it drops to 15 percent in the years after.

That’s not the only information Spotify left out about how their business works:

The majority of customers use their free, ad-supported product, which makes no contribution to the App Store.

A significant portion of Spotify’s customers come through partnerships with mobile carriers. This generates no App Store contribution, but requires Spotify to pay a similar distribution fee to retailers and carriers.

Even now, only a tiny fraction of their subscriptions fall under Apple’s revenue-sharing model. Spotify is asking for that number to be zero.

Apple ended its response by pointing out that the two companies shared a love of music, but that their approaches were significantly different.

“We share Spotify’s love of music and their vision of sharing it with the world. Where we differ is how you achieve that goal. Underneath the rhetoric, Spotify’s aim is to make more money off others’ work. And it’s not just the App Store that they’re trying to squeeze — it’s also artists, musicians and songwriters.”

Apple pointed out how Spotify sued music creators after the US Copyright Royalty Board required Spotify to increase its royalty payments. Spotify was recently ordered to pay $113 M in royalty payments to over 500,000 artists in a class-action lawsuit.

Apple explained how the App Store ecosystem has generated over $120 billion in revenue for App developers, launching new businesses and industries over the last 11 years. Apple built a safe and secure ecosystem with known rules.

“At its core, the App Store is a safe, secure platform where users can have faith in the apps they discover and the transactions they make. And developers, from first-time engineers to larger companies, can rest assured that everyone is playing by the same set of rules. That’s how it should be. We want more app businesses to thrive — including the ones that compete with some aspect of our business, because they drive us to be better.”

Despite Spotify’s contentious claims, Apple ended its response amicably.

“We’re proud of the work we’ve done to help Spotify build a successful business reaching hundreds of millions of music lovers, and we wish them continued success — after all, that was the whole point of creating the App Store in the first place.”