Disney+ Launches at $7/Mo: Our First Look

Elf

Taking the wraps off Disney+, Disney offers consumers a compelling, impressive lineup with popular favorites.

Image of Disney+ on tablet courtesy of Disney

Essentials about Disney+

launches Nov 12

$6.99/month

includes franchises Star Wars, Marvel, Pixar and Disney classic films

includes newer Disney films such as “Frozen”

includes favorites from Fox such as The Simpsons

includes National Geographic and Disney family-friendly TV programming

500 movies at launch, 7,500 episodes of television shows

25 original series

free of advertising

On April 11th, Disney CEO Bob Iger shared specifics about the entertainment company’s new online video streaming service, first announced back in November of last year, during an investor call. At the end of its two-hour and forty-five minute investor call to share details about Disney+. Disney’s new streaming service, Disney+ is priced at $6.99/month, which is roughly half of what consumers pay today for Netflix’s standard streaming package and also $2 less than Amazon Prime Video. Disney+ will launch on Nov 12. During the investor call, Disney CEO Bob Iger also briefly discussed bundling Disney+ with Hulu and ESPN but did not offer more details about timing or pricing.

“This is our first serious foray in this space and we want to reach as many people as possible.”

Disney+ Design and Features

Image via Disney

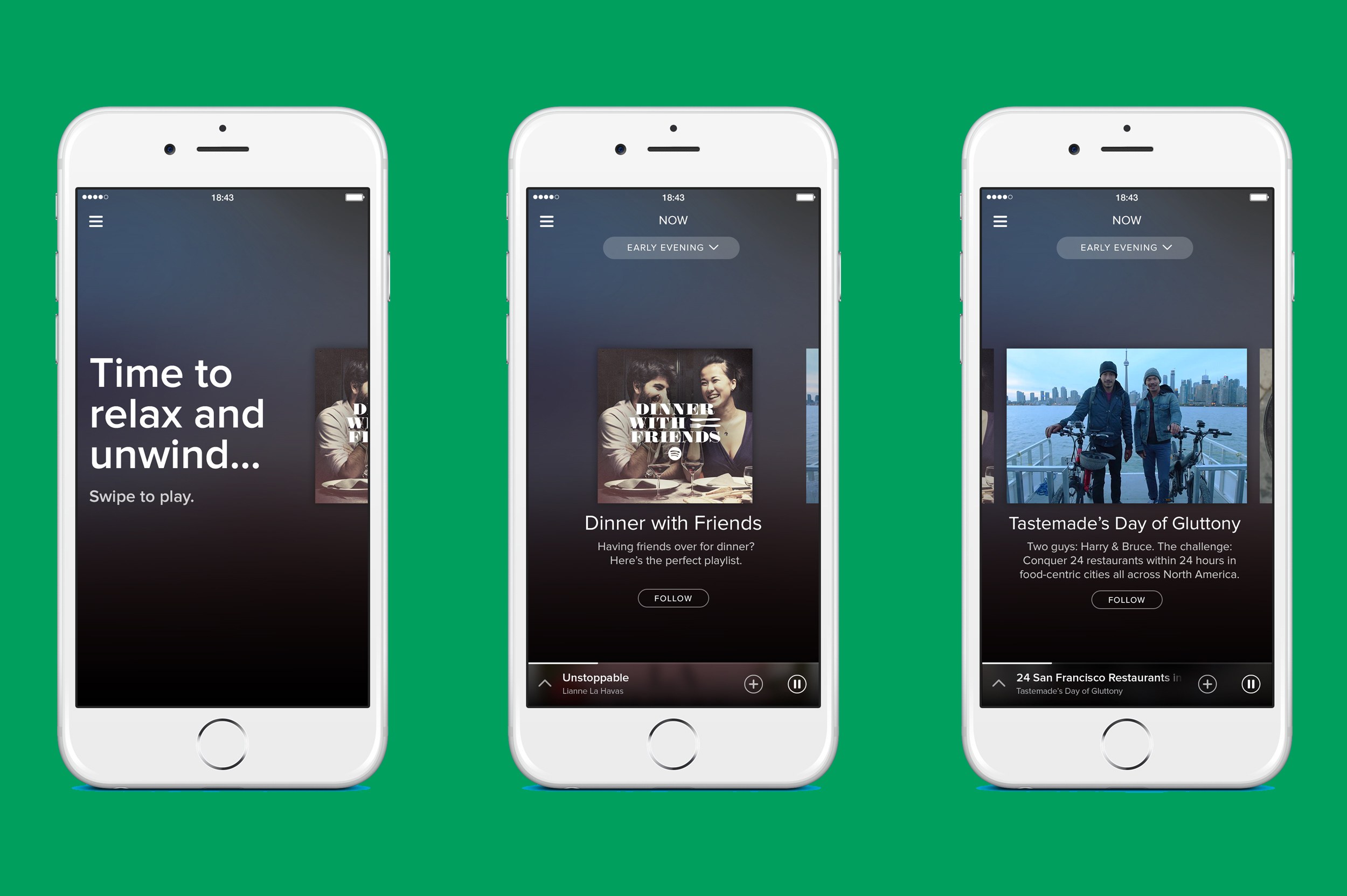

Launching November 12 of this year, Disney+ or Disney Plus will be viewable on web browsers, smartphones, smart TVs, set-top multimedia boxes and tablets. The service works in a similar fashion to Netflix or Hulu. Disney+ highlights new content and special releases at the top of the home screen. You can explore Disney’s quality lineup ranging from Marvel and Star Wars to Pixar, National Geographic, Disney classics and new Disney movies in the works. The app recommends titles similar to Netflix or Amazon based on personal taste and has parental control features. Disney Plus will stream both HDR and 4K video.

While the app’s appearance is consistent across devices, there are some minor differences depending upon the platform. For example, audiences watching on smart TVs also can view animations. Disney allows for offline viewing and downloading content on to mobile devices for Disney+ subscribers.

Disney+ Content

Image via Disney

Disney expects to showcase 500 movies that include 100 newer releases and 400 library titles of its iconic movies as well as 7,500 television shows. Disney+ expects to grow to 50 original series, 10,000 past TV episodes and 120 recent films within the next five years. As expected, the full library of content on Disney+ will be less than 20 percent of the content currently available on Netflix, according to a study by research firm Ampere Analysis. While Disney+’s streaming library is significantly smaller than Netflix’s collection, Disney+ boasts well known consumer favorite franchises and quality content. Disney+ reaps the benefits of Disney’s acquisitions of Marvel, Star Wars, Pixar and 21st Century Fox. Popular Disney classics such as “Snow White,” “101 Dalmatians” and “The Little Mermaid” as well as newer favorites such as “Captain Marvel,” “The Avengers: Endgame,” “Frozen 2”, “Toy Story 4” and “Star Wars: Episode IX — The Rise of Skywalker” will be exclusive to Disney+. “Captain Marvel” is the first movie in the Marvel Cinematic Universe that will not be available on Netflix.

Disney CEO Bob Iger shared that almost every single movie in the Disney catalog will eventually be available on the service, pulled out from its vault. While Netflix will continue to show existing Disney movies on its platform till the launch of Disney+, the streaming giant did announce that it was canceling the Daredevil TV series.

Disney+ will host the complete 30 seasons of “The Simpsons,” including all 662 episodes, as well as numerous family-friendly Fox programs. Disney acquired Fox back in 2017. Additional 20th Century Fox titles that will be on Disney+ include “The Sound of Music” and “Malcolm in the Middle.” Less family-friendly content from Fox is expected to go to Hulu, a company in which Disney owns a 60 percent stake. Disney+ will contain the entire Star Wars franchise as well as 18 Pixar movies at launch and Pixar’s animated shorts. Disney is also developing new series such as Monsters Inc. with Pixar and Star Wars television shows.

While Disney did not announce new Star Wars or Marvel projects during its Disney+ investor presentation, the company shared a quick preview of John Favreau’s highly anticipated Star Wars TV series, “The Mandolarian.” Favreau’s take on the popular Star Wars franchise is set seven years after the Battle of Endor in Return of the Jedi. The story follows “a lone gunfighter in the outer reaches of the galaxy far from the authority of the New Republic.” Additional Star Wars spinoffs include a live-action series with Diego Luna as Cassian Andor and a seventh season of Star Wars: The Clone Wars series.

Kevin Feige at Marvel Studios also shared that Tom Hiddleston will reappear as Loki in the new “Loki” series. Feige confirmed that Disney+ will be integrated with future feature films at Marvel and will add documentaries behind the scenes such as “Marvel 616” and “Marvel Heroes Project” TV shows.

Disney+ is also developing two new shows “Magic of the Animal Kingdom” and “The World According to Jeff Goldblum” for National Geographic, in addition to over 250 hours of existing National Geographic content. Additional Disney channel programming such as live-action kid movies, “Hannah Montana,” and “High School Musical: The Musical: The Series” will also be available on Disney+.

Additional series that are rumored to be in development for Disney+ include:

an untitled Muppet series

3 Men and a Baby

Don Quixote

Father of the Bride

Flora & Ulysses

Lady and the Tramp

Magic Camp

Noelle

The Paper Magician

The Parent Trap

The Sandlot

Stargirl

The Sword in the Stone

Timmy Failure

Togo

Honey, I Shrunk the Kids.

Ten Unscripted Series in the Works

In April, a report surfaced that Disney+ would also include ten unscripted series of the following projects listed below.

Marvel’s 616: a documentary about Marvel’s stories, characters and creators

Earthkeepers: a documentary about the people such as conservationists who are changing how we see animals.

Be Our Chef: a Disney-inspired cooking competition hosted by Angela Kinsey of The Office.

Cinema Relics: an anthology of film props, art and costumes.

Encore: a recreation of original performances from former members of a high school musical with The Good Place actress Kristen Bell as producer.

Marvel’s Hero Project: a documentary about inspiring kids who have demonstrated selfless acts of bravery and kindness.

(Re)Connect: a story about a family that breaks apart and the issues that drive families apart and how to resolve them.

Rogue Trip: a travelogue of places that most tourists would not dare to venture by Bob Woodruff and his 27-year old doppelgänger son, Mack.

Shop Class: a competitive series about inventive students tasked who design, build and test new contraptions.

Untitled Walt Disney Imagineering documentary series: a documentary about the people, craft and business behind Disney’s theme park magic.

Non-Disney content: content from National Geographic and 21st Century Fox’s magazine and affiliate TV businesses.

Audiences can also choose to fork out $69.99 for a full year subscription, saving $13.89. Whether consumers sign for the monthly or annual subscription, they can enjoy access to the full library that includes originals such as “Dumbo” and “Bambi” to Pixar’s “Finding Dory,” the full Star Wars collection and the 21 films currently on video from the Marvel Cinematic Universe. Marvel’s recent billion-dollar blockbuster, “Captain Marvel,” along with Marvel’s upcoming release “Avengers: Endgame” will stream exclusively on the new platform. “Frozen II,” the sequel to the 2013 musical fantasy that garnered $400.7 million nationwide, will launch in theaters November 22. After the movie completes its multiplex run, it will be available for streaming on Disney+ right after its theatrical window expires.

Disney+ Devices

Image via Disney

Disney+ will be available on smart TVs, web browsers, smartphones, tablets, TV boxes and game consoles like the Nintendo Switch. The company is working on launching its app on the PlayStation 4 and on Roku devices to be easily accessible to consumers everywhere.

Disney+ Availability

Image from Disney’s classic “Dumbo” (1941) via Disney

When Disney+ launches on November 12, 2019, the platform will be accessible throughout North America. Western Europe and the Asia-Pacific market will have access by Q2 of 2020 and Disney+ will roll out to all major markets within two years as Disney builds out deals with its partners around the world. Disney is also planning to create new content for the platform for $2.5 billion and to easily move over films after their theatrical releases direct to streaming. New TV series in the works include the live-action Star Wars series “The Mandalorian,” directed by Jon Favreau, known for directing the first Iron Man (2008) as well as the Marvel series “The Falcon and the Winter Soldier.”

Kathleen Kennedy and Jon Favreau at Disney+ investor presentation. Image via Disney

“Since we’re starting with new characters in a new time period, it’s a great way to bring in new fans.”

Favreau shared clips from the new series at the investor presentation. “Mandalorian” will consist of eight episodes. He is also the director of Disney’s live-action “Lion King” reboot, arriving in theaters July 19.

Disney expects to have 60-90 million new subscribers via Disney+ by 2024 with 30 percent coming from domestic markets, according to Morgan Stanley analyst Ben Swinburne in an April 8 note to investors. Disney+ is expected to have 5 million paying subscribers by the end of 2020. To build awareness about Disney+, Disney is launching a large marketing campaign across its properties such as Disney theme parks and important events such as Comic-Con. Through Disney’s TV networks (ESPN, ABC, Disney Channel and more) can connect to more than 100 million consumer households.

“[The company is set to unleash a] “synergy campaign of a magnitude that is unprecedented in the history of Disney.”

During the investor call, Disney CEO Bob Iger, who is responsible for Disney’s largest acquisitions such as Pixar Animation, Marvel Studios, Lucasfilm Ltd. and the entertainment assets of 21st Century Fox since becoming CEO in 2005, said that he will be stepping down from his contract at the end of 2021. Disney is in the process of finding a suitable replacement. Iger’s remarkable success as CEO took the entertainment company (DIS) from $23 a share to $130 a share when Disney+ was announced.

Wall Street responded well to Iger’s presentation of Disney+, its new streaming-video service. Netflix (NFLX) shares fell almost five percent on Thursday.